Take the stress out of tax season with these strategies for childcare businesses.

Download this guide to help you:

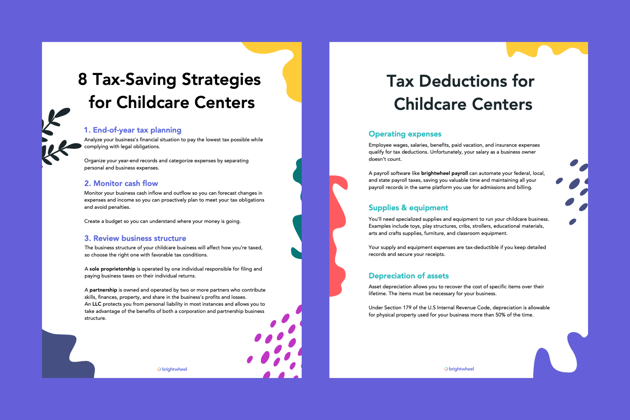

Navigating the complexities of tax season can be daunting for childcare business owners. This guide provides high-level tax strategies tailored specifically for childcare programs, covering practical strategies to maximize savings. By downloading this guide, you will gain valuable insights that can lead to increased cash flow and free up resources to reinvest in staff training, educational programs, marketing initiatives, and facility improvements.

Owners will find this guide useful for its detailed, actionable steps on managing finances and optimizing tax savings. It offers clear instructions on organizing year-end records, monitoring cash flow, and choosing the right business structure for favorable tax conditions. Following the strategies outlined in this guide not only ensures compliance with legal obligations but also helps childcare business owners allocate resources more effectively, ultimately enhancing the quality of care provided to children. This guide is an essential tool for any childcare business owner looking to achieve financial success and operational excellence during tax season.

After downloading this tax saving guide, explore additional early education resources to help you run your childcare business: