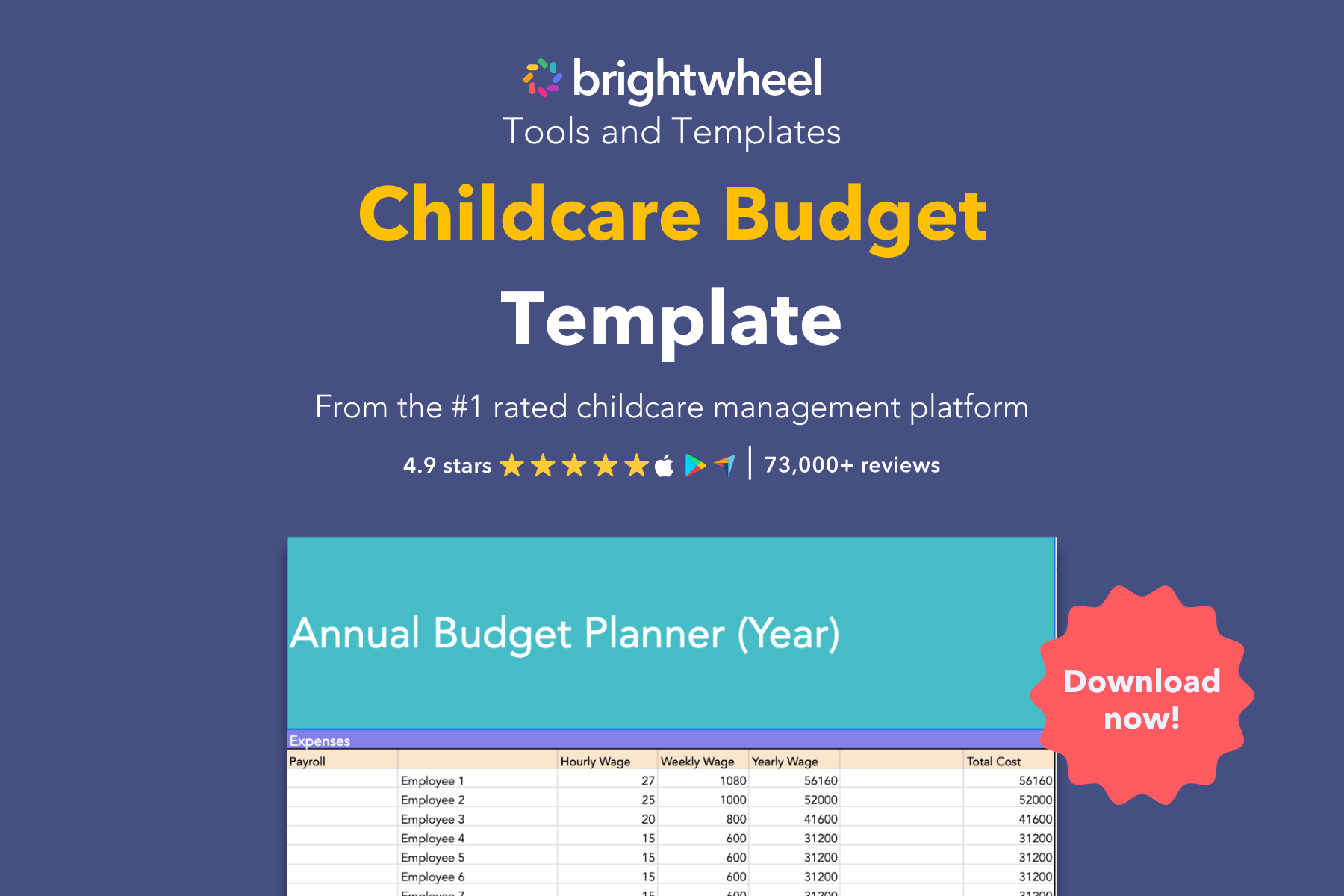

A childcare budget template is a financial tool designed to help childcare providers, preschool directors, and daycare owners track revenue and expenses. It provides a structured format to monitor cash flow, plan for operational costs, and ensure the long-term sustainability of your childcare program.

Running a successful childcare program requires more than just passion for early education; it requires financial stability. Our free preschool budget planner helps you move from guesswork to a data-driven financial plan.

By using this tool, you can:

To maintain a healthy business, it is critical to understand the two main sides of your ledger. This template helps you organize:

Childcare programs often have high overhead. This planner helps you categorize costs like:

Tracking income accurately ensures you can cover your costs. Use the template to monitor:

This spreadsheet is designed for ease of use, even if you are not a financial expert.

We strongly recommend you consult with your accountant or other financial experts for any specific questions regarding your tax obligations or long-term financial strategy.

After downloading the budget planner, explore these resources to help you manage your childcare business more effectively:

Q: Why do I need a specific budget template for childcare?

A: Childcare programs have unique revenue cycles (like weekly tuition) and specific compliance ratios that affect staffing costs. A generic business budget often lacks the specific line items a preschool or daycare needs to track accurately.

Q: How often should I update my childcare budget?

A: Review and update your budget monthly. Regular reviews allow you to catch cash flow issues early and adjust your spending or enrollment efforts before they become major problems.

Q: Can this planner help with tax preparation?

A: Yes, keeping a detailed record of expenses and revenue throughout the year makes tax season significantly easier. It ensures you have categorized proof of all business-related expenses.